No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

<small>[[Capability Modeling Guidelines|Capability Modelling Guidelines]] | [[Capability_Modeling_Guidelines:_How_to_use_Capabilities_to_Align_Investments_with_Purpose|How to use Capabilities to Align Investments with Purpose]]</small> | <small>[[Capability Modeling Guidelines|Capability Modelling Guidelines]] | [[Capability_Modeling_Guidelines:_How_to_use_Capabilities_to_Align_Investments_with_Purpose|How to use Capabilities to Align Investments with Purpose]]</small> | ||

=Benchmark | =Benchmark as-is capabilities= | ||

You’ve gathered many personal and informal views on the current performance of [[capabilities]] from interviews with business experts and leaders. Some assessments may align, while others may differ. In your subsequent iterations with these groups, use their input to build a shared [[capability]] performance assessment across the [[enterprise]]. Focus on the | You’ve gathered many personal and informal views on the current performance of [[capabilities]] from interviews with business experts and leaders. Some assessments may align, while others may differ. In your subsequent iterations with these groups, use their input to build a shared [[capability]] performance assessment across the [[enterprise]]. Focus on the 'distinctive' [[capabilities]] linked to the company’s vision, and compare them with those of competitors to identify performance gaps, strengths, and areas that need improvement. | ||

==Assessment | ==Assessment criteria== | ||

Your goal is to find consensus on [[capability]] assessments to get focus for your investments, not to have the most sophisticated assessment method. Begin with a simple evaluation of | Your goal is to find consensus on [[capability]] assessments to get focus for your investments, not to have the most sophisticated assessment method. Begin with a simple evaluation of 'performance' that measures how well you are performing compared to your competitors. | ||

Criterion | Criterion 'performance' per [[capability]]: | ||

*''Best in class'': other [[organisations]] see us as the benchmark. | *''Best in class'': other [[organisations]] see us as the benchmark. | ||

| Line 30: | Line 30: | ||

*''Sustainability'': taking care of planet and people for long-term success. | *''Sustainability'': taking care of planet and people for long-term success. | ||

==How | ==How well is competition performing its capabilities?== | ||

In competitive markets, knowing where to focus is always related to comparing your [[capabilities]] with those of competitors. Try to beat them in the playfield you’ve defined in your vision by building [[capabilities]] that make you unique in those markets. List relevant competitors based on similar industry, size (revenue, number of employees), market (same region, similar products and customer base) and use the following sources to estimate the performance of your competitors: | In competitive markets, knowing where to focus is always related to comparing your [[capabilities]] with those of competitors. Try to beat them in the playfield you’ve defined in your vision by building [[capabilities]] that make you unique in those markets. List relevant competitors based on similar industry, size (revenue, number of employees), market (same region, similar products and customer base) and use the following sources to estimate the performance of your competitors: | ||

*Ask LLMs using prompts like: | *Ask LLMs using prompts like: | ||

**'' | **'' 'For central-EU passenger travel, who are my competitors within and outside railway Enterprises?.' '' | ||

**'' | **'' 'Summarise what creates competitive advantage for each of the competitors in a table.' '' | ||

*''Competitor’s website'': products, pricing | *''Competitor’s website'': products, pricing | ||

*''Public data'': financial reports, ratings | *''Public data'': financial reports, ratings | ||

| Line 45: | Line 45: | ||

*''Employees'' who may have worked at competitors | *''Employees'' who may have worked at competitors | ||

== | ==iterate with your co-creators== | ||

Reaching an agreement on how well current [[capabilities]] are performing in comparison with your competitors may take many iterations. Start by getting senior leaders’ views on where the company is strong or weak. These insights are usually high-level but provide important strategic input. Include the right [[people]] to build a shared benchmark across the [[enterprise]]. Involve middle managers and experts, especially when disagreements arise. Address corporate politics and strive to resolve conflicts to achieve alignment. Stop debates about whether the [[capability]] is | |||

Reaching an agreement on how well current [[capabilities]] are performing in comparison with your competitors may take many iterations. Start by getting senior leaders’ views on where the company is strong or weak. These insights are usually high-level but provide important strategic input. Include the right [[people]] to build a shared benchmark across the [[enterprise]]. Involve middle managers and experts, especially when disagreements arise. Address corporate politics and strive to resolve conflicts to achieve alignment. Stop debates about whether the [[capability]] is 'important' or not, facilitate a discussion on performance compared to your peers. Probe the group for facts and dive deeper into the more specific criteria mentioned above. If [[people]] can’t reach a consensus, tag it for further review in a future iteration with senior leaders and move to the next [[capability]]. | |||

<br><br> | <br><br> | ||

<hr> | <hr> | ||

| Line 55: | Line 56: | ||

<br><br> | <br><br> | ||

<hr> | <hr> | ||

==Practical | ==Practical tips== | ||

'''Co-create the assessment criteria.''' | '''Co-create the assessment criteria.''' | ||

| Line 61: | Line 62: | ||

The assessment criteria are closely tied to the [[identity]] of the [[enterprise]]. What do we value most? Customer service or business continuity? Efficiency or adaptability? Sustainability or cost? Co-creating a simple yet effective assessment method together with relevant leaders and business experts reveals hidden assumptions about the [[enterprise|enterprise's]] [[identity]] and helps shape a shared understanding. | The assessment criteria are closely tied to the [[identity]] of the [[enterprise]]. What do we value most? Customer service or business continuity? Efficiency or adaptability? Sustainability or cost? Co-creating a simple yet effective assessment method together with relevant leaders and business experts reveals hidden assumptions about the [[enterprise|enterprise's]] [[identity]] and helps shape a shared understanding. | ||

When individuals understand [[enterprise]] [[identity]] better and why | When individuals understand [[enterprise]] [[identity]] better and why 'performance' is measured in a certain way, they are more inclined to participate actively in modelling and assessing [[capabilities]]. | ||

'''Make the assessment method transparent.''' | '''Make the assessment method transparent.''' | ||

Revision as of 09:47, 11 September 2025

Capability Modelling Guidelines | How to use Capabilities to Align Investments with Purpose

Benchmark as-is capabilities

You’ve gathered many personal and informal views on the current performance of capabilities from interviews with business experts and leaders. Some assessments may align, while others may differ. In your subsequent iterations with these groups, use their input to build a shared capability performance assessment across the enterprise. Focus on the 'distinctive' capabilities linked to the company’s vision, and compare them with those of competitors to identify performance gaps, strengths, and areas that need improvement.

Assessment criteria

Your goal is to find consensus on capability assessments to get focus for your investments, not to have the most sophisticated assessment method. Begin with a simple evaluation of 'performance' that measures how well you are performing compared to your competitors.

Criterion 'performance' per capability:

- Best in class: other organisations see us as the benchmark.

- Above average: exceeds industry norms.

- Average: meets the minimum level required to operate.

- Below the average: not adequate to operate the business in the long term.

- Well below the average: not adequate to operate the business in the near term.

This simple criterion, developed through the wisdom and intuition of the many co-creators, works effectively in many cases.

Dive deeper into specific aspects of capabilities when there is strong disagreement between co-creators about their importance or performance. Typical criteria for a deeper assessment can be:

- Efficiency: how efficiently the processes of the capability are being performed.

- Customer Service: response time.

- Business continuity: mitigating operational risk.

- Adaptability & innovation: how quickly can we adapt a capability to changes in the ecosystem?

- People: availability and skill level of the required human resources, employee satisfaction.

- Technology: level of automation, modernity of the underlying technology (IT, machines, etc.), and technical debt.

- Cost: operational cost associated with executing the Capability.

- Sustainability: taking care of planet and people for long-term success.

How well is competition performing its capabilities?

In competitive markets, knowing where to focus is always related to comparing your capabilities with those of competitors. Try to beat them in the playfield you’ve defined in your vision by building capabilities that make you unique in those markets. List relevant competitors based on similar industry, size (revenue, number of employees), market (same region, similar products and customer base) and use the following sources to estimate the performance of your competitors:

- Ask LLMs using prompts like:

- 'For central-EU passenger travel, who are my competitors within and outside railway Enterprises?.'

- 'Summarise what creates competitive advantage for each of the competitors in a table.'

- Competitor’s website: products, pricing

- Public data: financial reports, ratings

- Research firms: industry benchmarks, market research

- Social Media and online forums: client comments and ratings

- Mystery shopping: sign up for competitor products or services

- Customer surveys: ask your customers why they use or left a competitor

- Employees who may have worked at competitors

iterate with your co-creators

Reaching an agreement on how well current capabilities are performing in comparison with your competitors may take many iterations. Start by getting senior leaders’ views on where the company is strong or weak. These insights are usually high-level but provide important strategic input. Include the right people to build a shared benchmark across the enterprise. Involve middle managers and experts, especially when disagreements arise. Address corporate politics and strive to resolve conflicts to achieve alignment. Stop debates about whether the capability is 'important' or not, facilitate a discussion on performance compared to your peers. Probe the group for facts and dive deeper into the more specific criteria mentioned above. If people can’t reach a consensus, tag it for further review in a future iteration with senior leaders and move to the next capability.

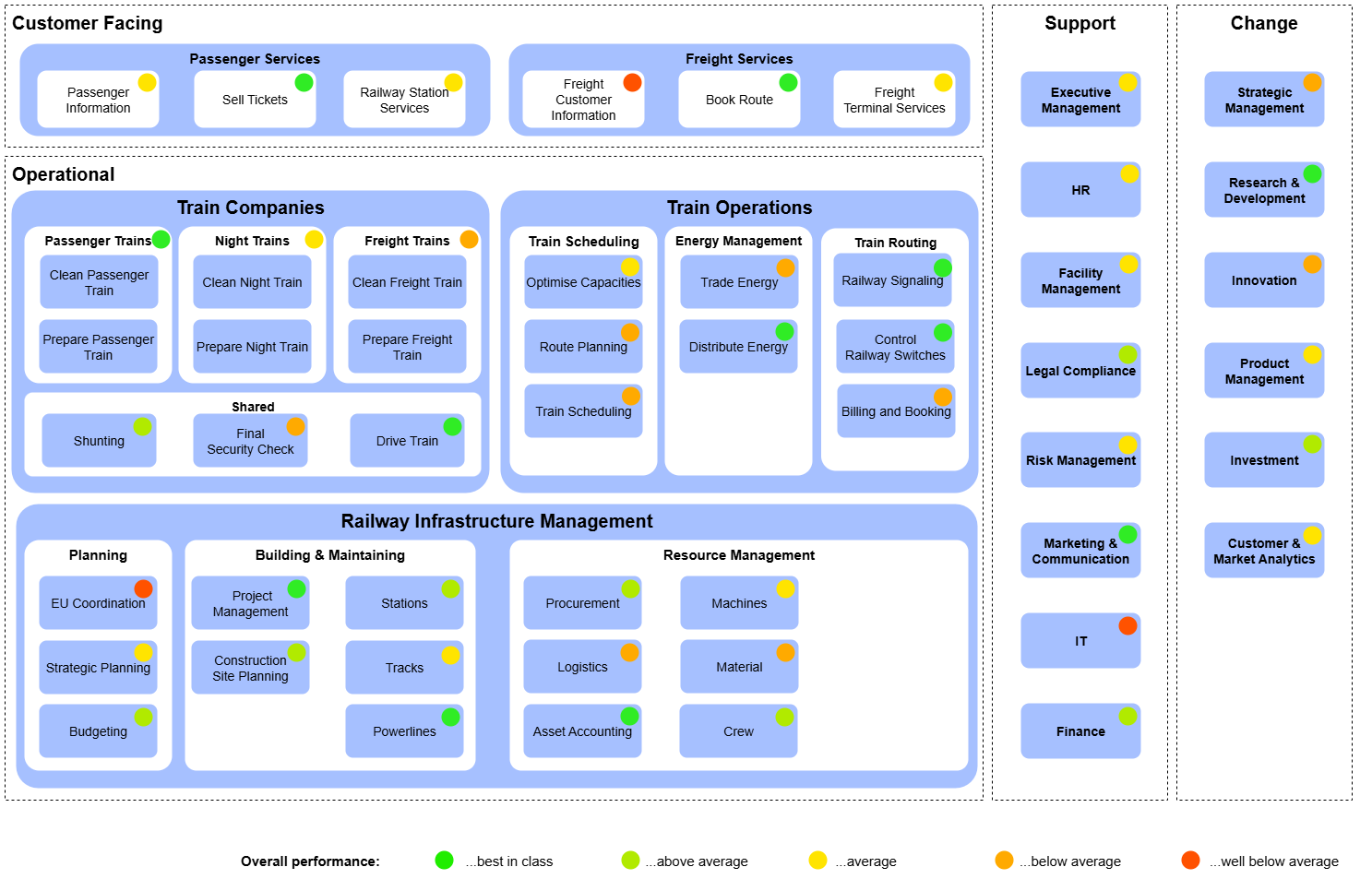

Example: Capability Map of Intersection Railways after benchmarking it with co-creators

Practical tips

Co-create the assessment criteria.

The assessment criteria are closely tied to the identity of the enterprise. What do we value most? Customer service or business continuity? Efficiency or adaptability? Sustainability or cost? Co-creating a simple yet effective assessment method together with relevant leaders and business experts reveals hidden assumptions about the enterprise's identity and helps shape a shared understanding.

When individuals understand enterprise identity better and why 'performance' is measured in a certain way, they are more inclined to participate actively in modelling and assessing capabilities.

Make the assessment method transparent.

Criteria (such as cost) can be quantitative, while others (like overall performance) are more qualitative and require judgment. Be transparent about the assessment method.

Involve relevant business experts and senior leaders to gain consensus and ensure accuracy.